03/26/2014

Federal Reserve completes review of RBS Citizens Financial Group’s 2014 Capital Plan

PROVIDENCE, R.I. – RBS Citizens Financial Group, Inc. (“RBSCFG” or ‘the Company”) announced today that the Board of Governors of the Federal Reserve (“Federal Reserve” or “The Fed”) has completed its review of the company’s 2014 capital plan and objected to certain qualitative aspects of the plan. The Federal Reserve did not object to RBSCFG’s continuation of capital actions at a level consistent with those executed in 2013. The CCAR results follow the Federal Reserve’s March 24, 2014 publication of Dodd-Frank Act Stress Test (DFAST) results. In that test, across every category, RBSCFG’s projected capital ratios ranked in the top quartile of the 30 largest bank holding companies under the hypothetical Supervisory Severely Adverse Stress scenario.

“RBSCFG continues to be one of the best-capitalized banks in the industry and we’re pleased to be able to continue normalizing our capital structure, through dividends and subordinated debt exchanges with our parent at the same pace as last year,” said Bruce Van Saun, RBSCFG Chairman and Chief Executive Officer. “We clearly have more work to do to meet the Fed’s standards, and we’re fully committed to doing that.”

RBSCFG’s 2014 Capital Plan was designed to ensure a strong capital position at RBSCFG, provide adequate returns to its shareholders, and normalize its capital structure.

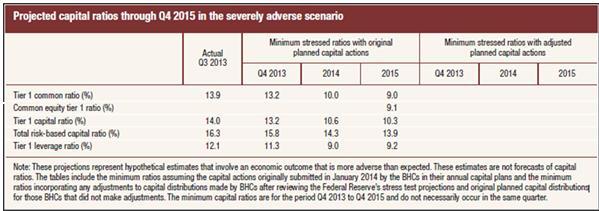

As published in today’s Federal Reserve disclosure, RBSCFG’s CCAR results under the Federal Reserve hypothetical severely adverse economic scenario are as follows:

The Federal Reserve does not permit bank holding companies to disclose confidential supervisory information including any reason for an objection to capital plans submitted in the CCAR process. However, the Federal Reserve has an established process for resubmission of CCAR capital plans, which are fully described in the Capital Plans rule. RBSCFG expects to resubmit its capital plan, as soon as practicable, to address the elements of the plan that were the focus of the Federal Reserve’s objections. The Federal Reserve does not permit bank holding companies to disclose the ongoing status of any resubmitted capital plan.

RBSCFG also announced today the disclosure on its website of its company-run stress tests for RBSCFG and its subsidiary insured depository institution, RBS Citizens, N.A. This disclosure is required under the Federal Reserve’s Stress Test Final Rule in accordance with the DFAST regulation (12 CFR Part 252).

The public disclosure of the Federal Reserve’s 2014 Comprehensive Capital Analysis and Review (CCAR) results for all participating bank holding companies is available on the Federal Reserve’s website.

About RBS Citizens Financial Group, Inc.

RBS Citizens Financial Group, Inc. is a $122 billion commercial bank holding company. It is headquartered in Providence, R.I., and through its subsidiaries has approximately 1,400 branches, over 3,500 ATMs and more than 18,000 colleagues. It operates a branch network in 12 states and has non-branch retail and commercial offices in more than 30 states. Its two bank subsidiaries are RBS Citizens, N.A., and Citizens Bank of Pennsylvania. They operate a branch network under the Citizens Bank brand in Connecticut, Delaware, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island and Vermont; and the Charter One brand in Illinois, Michigan and Ohio. RBSCFG is owned by RBS (the Royal Bank of Scotland Group plc). RBSCFG’s website is citizensbank.com